Vivo Capital Fund Ix, L.p. - Net Worth and Insider Trading

Vivo Capital Fund Ix, L.p. Net Worth

The estimated net worth of Vivo Capital Fund Ix, L.p. is at least $176 Million dollars as of 2024-05-13. Vivo Capital Fund Ix, L.p. is the 10% Owner of Tarsus Pharmaceuticals Inc and owns about 2,469,001 shares of Tarsus Pharmaceuticals Inc (TARS) stock worth over $91 Million. Vivo Capital Fund Ix, L.p. is the 10% Owner of ALX Oncology Holdings Inc and owns about 4,220,048 shares of ALX Oncology Holdings Inc (ALXO) stock worth over $68 Million. Vivo Capital Fund Ix, L.p. is also the 10% Owner of IO Biotech Inc and owns about 6,173,439 shares of IO Biotech Inc (IOBT) stock worth over $9 Million. Besides these, Vivo Capital Fund Ix, L.p. also holds Instil Bio Inc (TIL) . Details can be seen in Vivo Capital Fund Ix, L.p.'s Latest Holdings Summary section.

Disclaimer: The insider information is derived from SEC filings. The estimated net worth is based on the assumption that Vivo Capital Fund Ix, L.p. has not made any transactions after 2023-08-09 and currently still holds the listed stock(s).

Transaction Summary of Vivo Capital Fund Ix, L.p.

Vivo Capital Fund Ix, L.p. Insider Ownership Reports

Based on ownership reports from SEC filings, as the reporting owner, Vivo Capital Fund Ix, L.p. owns 5 companies in total, including Tarsus Pharmaceuticals Inc (TARS) , ALX Oncology Holdings Inc (ALXO) , and Sierra Oncology Inc (SRRA) among others .

Click here to see the complete history of Vivo Capital Fund Ix, L.p.’s form 4 insider trades.

Insider Ownership Summary of Vivo Capital Fund Ix, L.p.

| Ticker | Comapny | Transaction Date | Type of Owner |

|---|---|---|---|

| TARS | Tarsus Pharmaceuticals Inc | 2022-05-05 | 10 percent owner |

| ALXO | ALX Oncology Holdings Inc | 2020-07-21 | 10 percent owner |

| SRRA | Sierra Oncology Inc | 2019-11-22 | 10 percent owner |

| 2021-03-23 | 10 percent owner | ||

| 2023-08-09 | 10 percent owner |

Vivo Capital Fund Ix, L.p. Latest Holdings Summary

Vivo Capital Fund Ix, L.p. currently owns a total of 4 stocks. Among these stocks, Vivo Capital Fund Ix, L.p. owns 2,469,001 shares of Tarsus Pharmaceuticals Inc (TARS) as of May 5, 2022, with a value of $91 Million and a weighting of 51.96%. Vivo Capital Fund Ix, L.p. owns 4,220,048 shares of ALX Oncology Holdings Inc (ALXO) as of July 21, 2020, with a value of $68 Million and a weighting of 38.91%. Vivo Capital Fund Ix, L.p. also owns 6,173,439 shares of IO Biotech Inc (IOBT) as of August 9, 2023, with a value of $9 Million and a weighting of 5.02%. The other 1 stocks Instil Bio Inc (TIL) have a combined weighting of 4.11% among all his current holdings.

Latest Holdings of Vivo Capital Fund Ix, L.p.

| Ticker | Comapny | Latest Transaction Date | Shares Owned | Current Price ($) | Current Value ($) |

|---|---|---|---|---|---|

| TARS | Tarsus Pharmaceuticals Inc | 2022-05-05 | 2,469,001 | 37.00 | 91,353,037 |

| ALXO | ALX Oncology Holdings Inc | 2020-07-21 | 4,220,048 | 16.21 | 68,406,978 |

| IOBT | IO Biotech Inc | 2023-08-09 | 6,173,439 | 1.43 | 8,828,018 |

| TIL | Instil Bio Inc | 2021-03-23 | 624,339 | 11.58 | 7,229,846 |

Holding Weightings of Vivo Capital Fund Ix, L.p.

Vivo Capital Fund Ix, L.p. Form 4 Trading Tracker

According to the SEC Form 4 filings, Vivo Capital Fund Ix, L.p. has made a total of 6 transactions in Tarsus Pharmaceuticals Inc (TARS) over the past 5 years, including 1 buys and 5 sells. The most-recent trade in Tarsus Pharmaceuticals Inc is the sale of 5,374 shares on May 5, 2022, which brought Vivo Capital Fund Ix, L.p. around $65,832.

According to the SEC Form 4 filings, Vivo Capital Fund Ix, L.p. has made a total of 1 transactions in ALX Oncology Holdings Inc (ALXO) over the past 5 years, including 1 buys and 0 sells. The most-recent trade in ALX Oncology Holdings Inc is the acquisition of 975,000 shares on July 21, 2020, which cost Vivo Capital Fund Ix, L.p. around $19 Million.

According to the SEC Form 4 filings, Vivo Capital Fund Ix, L.p. has made a total of 2 transactions in IO Biotech Inc (IOBT) over the past 5 years, including 2 buys and 0 sells. The most-recent trade in IO Biotech Inc is the acquisition of 3,157,894 shares on August 9, 2023, which cost Vivo Capital Fund Ix, L.p. around $6 Million.

More details on Vivo Capital Fund Ix, L.p.'s insider transactions can be found in the Insider Trading History of Vivo Capital Fund Ix, L.p. table.Insider Trading History of Vivo Capital Fund Ix, L.p.

- 1

Vivo Capital Fund Ix, L.p. Trading Performance

GuruFocus tracks the stock performance after each of Vivo Capital Fund Ix, L.p.'s buying transactions within different timeframes. To be detailed, the average return of stocks after 3 months bought by Vivo Capital Fund Ix, L.p. is 3.43%. GuruFocus also compares Vivo Capital Fund Ix, L.p.'s trading performance to market benchmark return within the same time period. The performance of stocks bought by Vivo Capital Fund Ix, L.p. within 3 months outperforms 2 times out of 5 transactions in total compared to the return of S&P 500 within the same period.

You can select different timeframes to see how Vivo Capital Fund Ix, L.p.'s insider trading performs compared to the benchmark.

Performance of Vivo Capital Fund Ix, L.p.

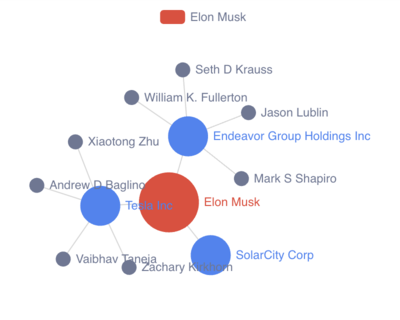

Vivo Capital Fund Ix, L.p. Ownership Network

Vivo Capital Fund Ix, L.p. Owned Company Details

What does Tarsus Pharmaceuticals Inc do?

Who are the key executives at Tarsus Pharmaceuticals Inc?

Vivo Capital Fund Ix, L.p. is the 10 percent owner of Tarsus Pharmaceuticals Inc. Other key executives at Tarsus Pharmaceuticals Inc include Chief Human Resources Officer Dianne C. Whitfield , General Counsel Bryan Wahl , and Chief Commercial Officer Aziz Mottiwala .

Tarsus Pharmaceuticals Inc (TARS) Insider Trades Summary

Over the past 18 months, Vivo Capital Fund Ix, L.p. made no insider transaction in Tarsus Pharmaceuticals Inc (TARS). Other recent insider transactions involving Tarsus Pharmaceuticals Inc (TARS) include a net sale of 337,867 shares made by Bobak R. Azamian , a net sale of 31,966 shares made by Leonard M. Greenstein , and a net sale of 20,877 shares made by Aziz Mottiwala .

In summary, during the past 3 months, insiders sold 28,810 shares of Tarsus Pharmaceuticals Inc (TARS) in total and bought 0 shares, with a net sale of 28,810 shares. During the past 18 months, 441,842 shares of Tarsus Pharmaceuticals Inc (TARS) were sold and 10,506 shares were bought by its insiders, resulting in a net sale of 431,336 shares.

Tarsus Pharmaceuticals Inc (TARS)'s detailed insider trading history can be found in Insider Trading Tracker table.

Tarsus Pharmaceuticals Inc Insider Transactions

Vivo Capital Fund Ix, L.p. Mailing Address

Above is the net worth, insider trading, and ownership report for Vivo Capital Fund Ix, L.p.. You might contact Vivo Capital Fund Ix, L.p. via mailing address: 192 Lytton Avenue, Palo Alto Ca 94301.